Life Insurance in and around Annandale

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It may make you uneasy to fixate on when you pass, but preparing for that day with life insurance is one of the most significant ways you can demonstrate love to your partner.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Life Insurance Options To Fit Your Needs

Having the right life insurance coverage can help loss be a bit less stressful for your partner and provide space to grieve. It can also help meet important needs like childcare costs, utility bills and retirement contributions.

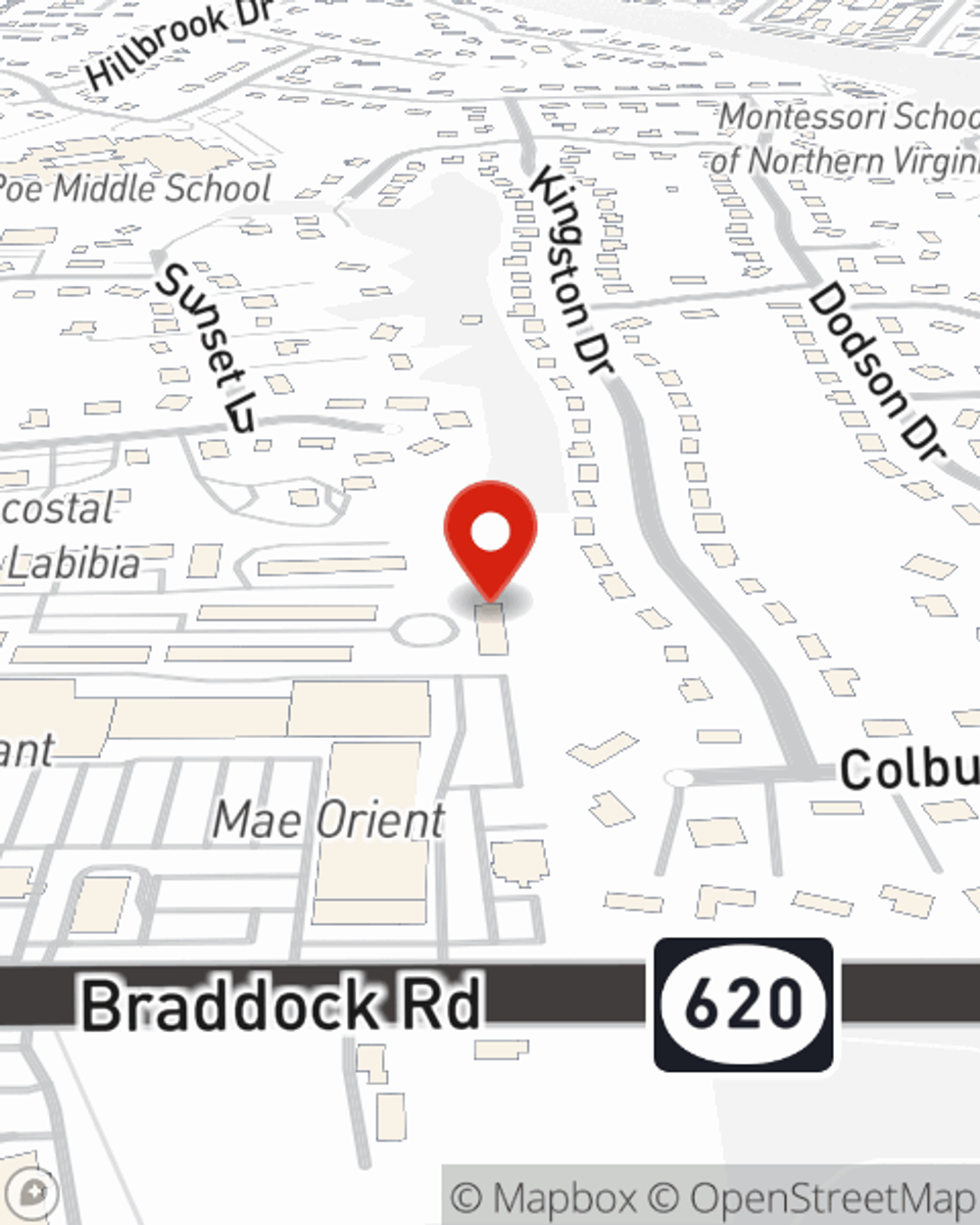

Don’t let concerns about your future make you unsettled. Visit State Farm Agent Anh Nguyen today and learn more about how you can benefit from State Farm life insurance.

Have More Questions About Life Insurance?

Call Anh at (703) 462-8700 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.