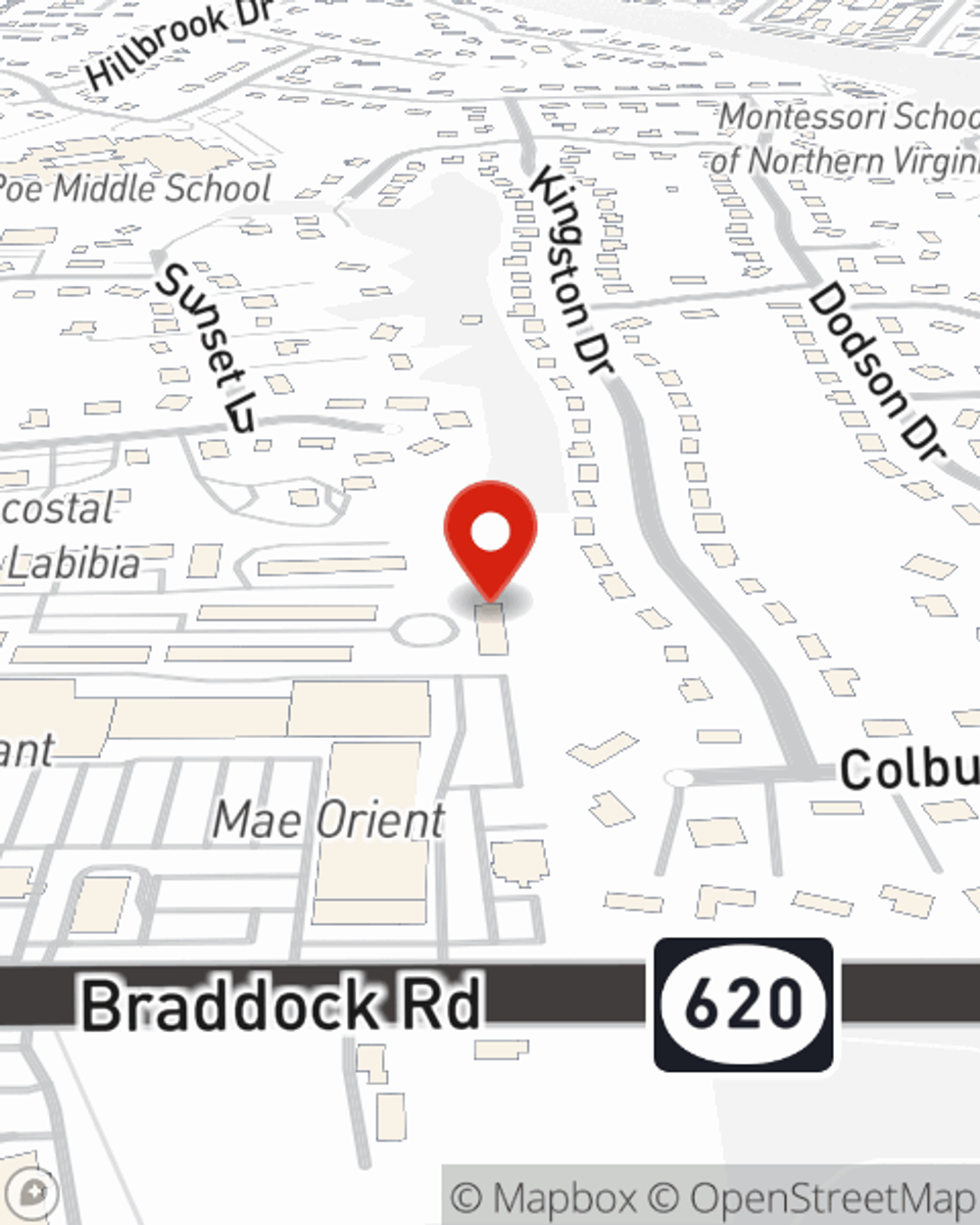

Renters Insurance in and around Annandale

Looking for renters insurance in Annandale?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

Home is home even if you are leasing it. And whether it's a townhome or a condo, protection for your personal belongings is beneficial, whether or not your landlord requires it.

Looking for renters insurance in Annandale?

Your belongings say p-lease and thank you to renters insurance

Why Renters In Annandale Choose State Farm

Renters often don’t realize that their landlord’s insurance only covers the structure. Just because you are renting a property or townhome, you still own plenty of property and personal items—such as a bed, set of golf clubs, laptop, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why choose renters insurance from Anh Nguyen? You need an agent with the knowledge needed to help you choose the right policy and evaluate your risks. With personal attention and efficiency, Anh Nguyen stands ready to help you protect yourself from the unexpected.

Reach out to Anh Nguyen's office to discover the advantages of State Farm's renters insurance to help keep your personal property protected.

Have More Questions About Renters Insurance?

Call Anh at (703) 462-8700 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.